Market Monitor: January 2025

As we welcome 2025, the market landscape looks very familiar, but the political arena has changed dramatically following the November U.S. elections. Republicans have gained control of the White House and both houses of Congress. This likely portends a number of key fiscal policy changes and new laws to come over the next several years. While markets have historically tended to react with skepticism to major change in Washington D.C., this year, we have seen the stock market momentum continue during the 4th quarter. We will learn a lot in the first 100 days of the new administration. Investors are hoping for clarity on tax rates, tariff plans, immigration laws, and a host of other campaign themes that may impact the economy in the years ahead.

4th Quarter Highlights

- U.S. stocks barely missed a beat in the 4th quarter of 2024, continuing their extraordinary run higher. The S&P 500 increased 25.0% for the year, after a 26.3% increase in 2023. While technology and AI themes stole the headlines, we saw more market breadth in the second half of the year with support from the communication services, financials, and consumer discretionary sectors.

- Non-U.S. stocks were in the midst of an impressive return year in their own right, up 13.0% through September, until the election stirred up themes of a strong dollar and potentially costly tariffs. The MSCI EAFE Index of developed markets ended the year with a return of only 3.8%. Emerging Markets, as measured by the FTSE EM Index, fared much better, gaining 12.4% in 2024.

- Inflation continues to slowly ebb, inching closer to the Federal Reserve’s target of 2.0%. CPI increased 2.7% in November compared to November 2023, but prices remain somewhat sticky, and bond investors are at present unconvinced that getting to 2.0% is a certainty.

- The 10-year Treasury yield had a wild ride in 2024. After starting the year at 4.0%, bonds sold off and the yield climbed to 4.7% in April and then declined to 3.6% in September as the Fed began to reduce short term rates. However, persistent inflation and the election impact brought more selling and higher rates by the end of the year. The 10-year Treasury exited 2024 with a yield of 4.6%.

- Trump campaign promises such as tariffs and stimulative tax breaks have revived the inflation conversation and caused bond investors to sit on the sidelines for the moment. The Bloomberg Aggregate Bond Index returned a meager 1.8% for the year.

- As we enter 2025, U.S. economic growth remains strong, and the unemployment rate remains low at 4.2% as of November.

Three Big Things

Here we review some emerging trends that may be important for investors and their portfolios. We look at historically high stock valuations, the performance of the S&P 500 following two consecutive strong return years, and the tricky task of cutting government spending.

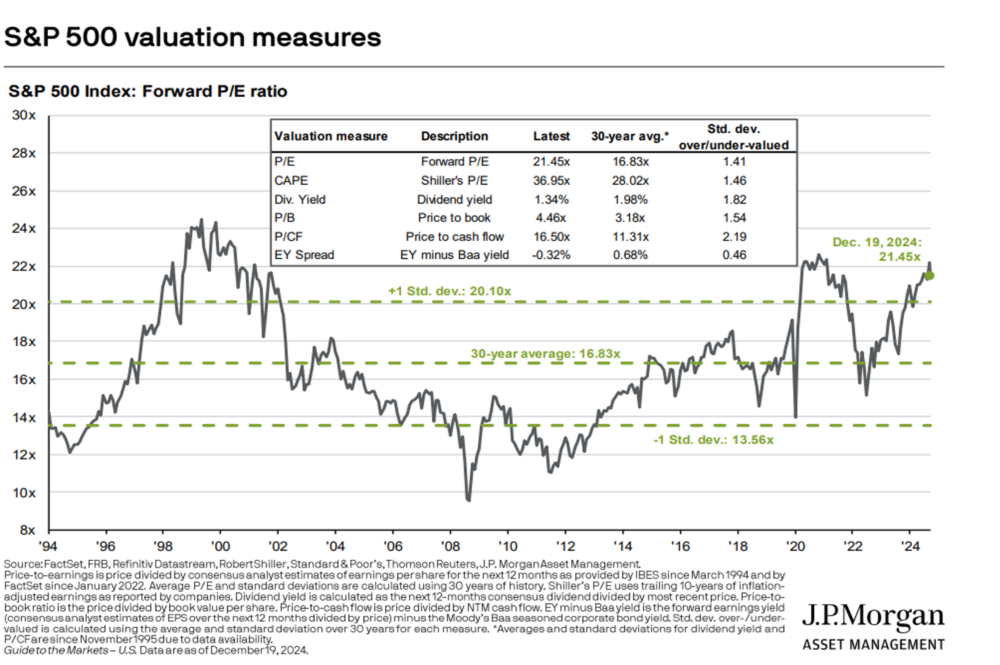

Stock Valuations

While we have seen plenty of volatility since the Credit Crisis of 2008-2009, stocks have provided strongly positive returns over the last 15 years. The earnings of the S&P 500 companies have grown substantially, but not quite as fast as market prices. We can see from the chart below that the ratio of price to earnings (PE Ratio) is at the high end of the historical range as of December 2024, led by technology names that make up a large portion of the index. Although this data may not provide an action item in the short run, higher starting PEs have historically led to weaker returns over longer time periods.

Returns After Strong Performance Periods

The S&P 500 Index increased by more than 25% for 2023 and 2024. Many investors may be wondering what typically comes next after this happens. The data below contains a look at the ensuing periods after stocks have had two consecutive years with more than 20% growth. While past performance is not predictive of the future, it is a reminder that rebalancing the portfolio may indeed be a timely move.

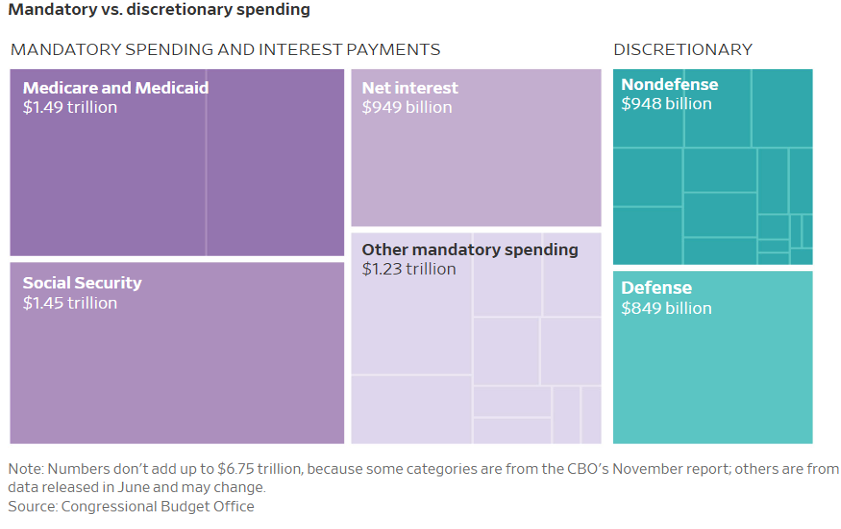

How to Cut Government Spending

There is much talk after election season of making the U.S. government more efficient, but where can budget cuts come from? The chart below shows the breakdown of the government budget based on discretionary and mandatory (non-discretionary) spending. Mandatory spending is required by law and not subject to annual Congressional approval. Any rapid cuts would likely have to come from the discretionary budget and may not be very impactful in the grand scheme.

Happy New Year! We look forward to the opportunity to work with you again in 2025. We will be connecting with you to review your wealth management plan in the coming months. As always, please do not hesitate to reach out to us at any time.

Please find this newsletter and others on our website at www.gardecapital.com.

This article was published by Garde Capital, Inc. a Seattle based Registered Investment Advisor that provides wealth management solutions to individuals and families, nonprofit organizations, and corporate retirement plans.

Copyright 2025 by Garde Capital, Inc.