Market Monitor: April 2025

For years, tariffs have lingered in the background of political and economic discussions, familiar, but rarely front and center. Recently, however, they’ve surged into the spotlight, becoming the dominant concern for investors across the globe. The uncertainty surrounding their implementation and the resulting ripple effects on global trade have led many to hit the brakes, reconsider growth strategies, and brace for what’s next. While first-quarter investment returns revealed some notable trends, the real story will begin to unfold in the second quarter as these impacts start to take shape in the data.

1st Quarter Highlights

- Investors experienced a new phenomenon in the first quarter of 2025. U.S. stocks underperformed both non-U.S. stocks and bonds as the dollar declined during the first three months of the year and tariff uncertainty took hold.

- Large U.S. stocks, as measured by the S&P 500 Index, declined 4.3% during the first quarter, led lower by technology shares that had risen to lofty valuations. Small cap stocks also suffered, as growth expectations have been called into question. The Russell 2000 Index of small cap stocks finished the quarter down 9.5%.

- In an encouraging turn for globally diversified investors, developed stock markets led the way this quarter, and emerging markets delivered positive returns as well. The MSCI EAFE Index of developed markets finished the quarter up 6.7% while emerging markets, as measured by the MSCI EM Index, gained 2.9%.

- Bonds also rallied in the quarter as the Bloomberg Aggregate Bond Index rose 2.8%. Bond yields saw modest declines in the first three months of the year. The 10-year Treasury yield ended the quarter at 4.2%.

- Investors and analysts alike are scrambling to make sense of a new world order in global trade. President Trump launched the first volley in February with a 10% tariff on all Chinese imports. China then retaliated with tariffs of their own, and the economic war was on. As of the time of this writing, the U.S. has implemented a 145% tariff on China, China has responded with a 125% tariff on U.S. imports, and the White House is now proposing to engage in customized negotiations with the vast majority of trading partners to strike a deal.

- What does all of this mean for investors? At present, nobody knows, as the Trump administration could literally change its mind at any moment and move in a different direction. Indeed, a 90-day pause in the tariffs on a wide range of trading partners on April 9th resulted in a 9.5% gain in the S&P 500 Index, the largest one-day percentage gain since the Credit Crisis.

- As we wait for further developments, it seems likely that the uncertainty created by the tariff wars will have a negative impact on corporate earnings in 2025 as decision times increase and deals are delayed.

- While the Trump administration insists that consumers will ultimately see a reduction in the prices of goods and services, the Federal Reserve remains cautious on inflation and seems no closer to reducing short term rates at the moment.

- As of April 15th, the S&P 500 has declined 7.8% for the year, while the MSCI EAFE Index remains relatively unchanged, up 6.3%.

Three Big Things

Here we review some emerging themes that may be important for investors and their portfolios. We look at some surprising global performance trends, the recent slide of the U.S. dollar, and a bit of perspective on volatility.

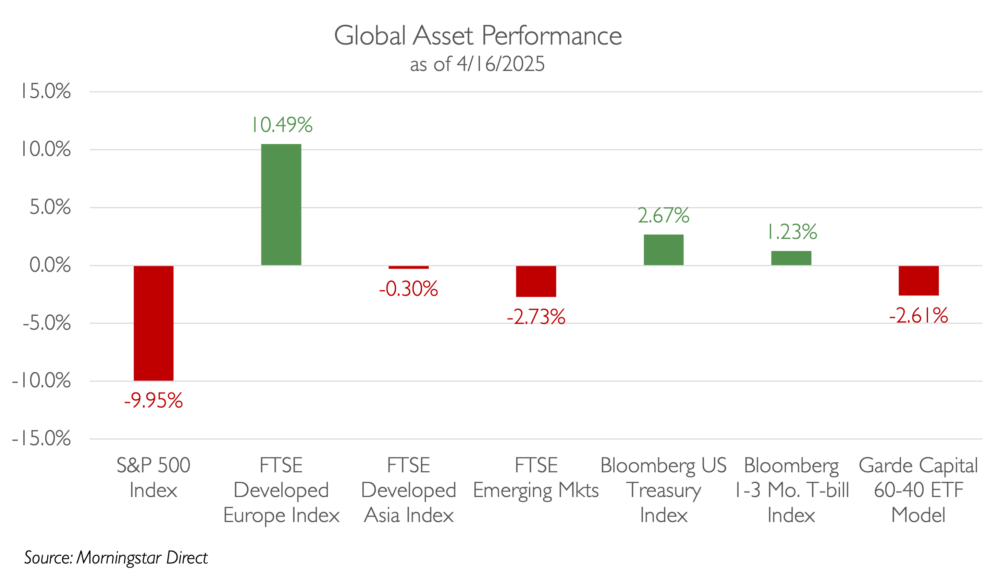

Global Asset Performance

The chart below shows the performance of various asset classes for the year-to-date period ending April 16th. Notable segments include the S&P 500 Index, down almost 10% and the Developed Europe Index, up over 10%. For most of the last decade, we have seen U.S. markets leading the way, but history has demonstrated that changes of leadership happen routinely.

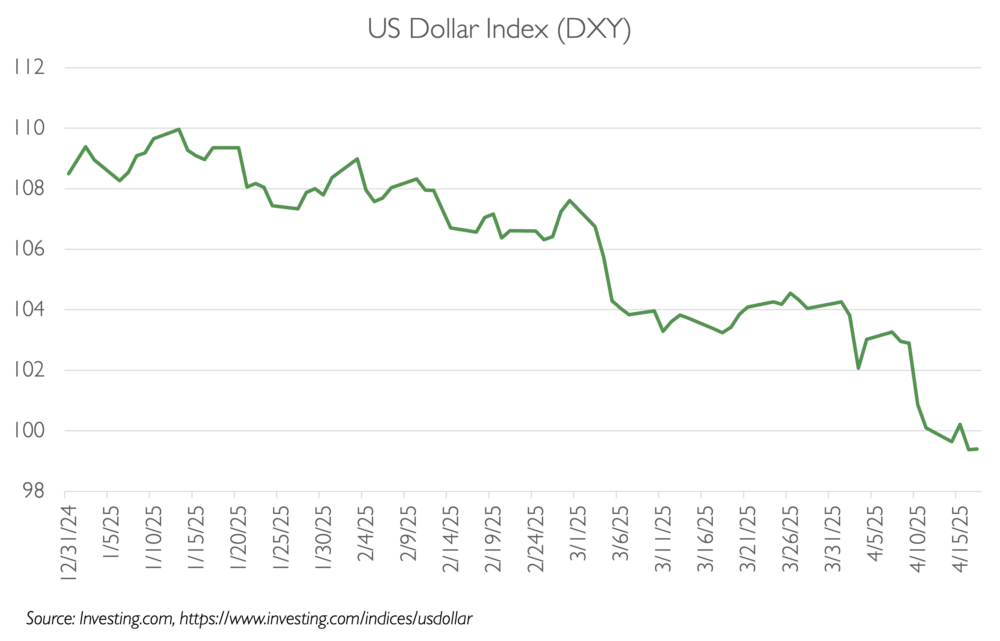

Dollar Sliding

When considering U.S. market performance compared to the rest of the globe, it is helpful to understand that the movement of the dollar relative to other world currencies plays a role. Recent weakness in the dollar compared to a basket of foreign currencies can be seen below. When we own non-U.S. assets, those must be converted to U.S. dollars when calculating returns. Strength in foreign currencies means that they can buy more U.S. dollars which boosts the dollar return of those assets.

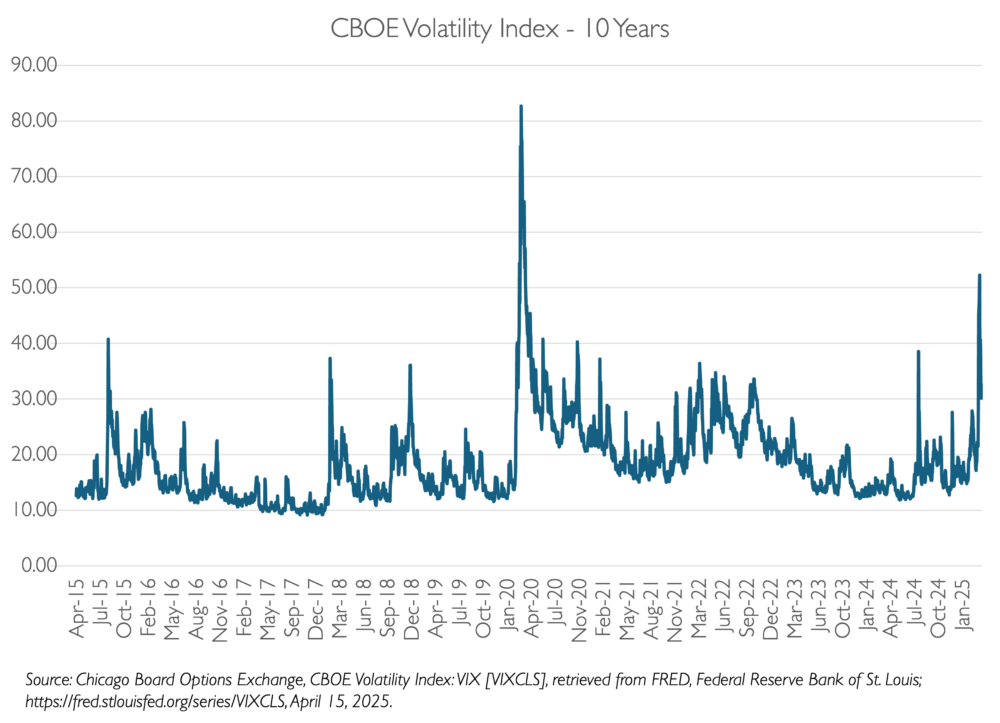

Market Volatility

The last several weeks have been unnerving for investors. On the whole, portfolios have held up well, but the daily movements in stock prices are larger than we have seen in some time. It’s not just our imaginations running wild! The data below shows the CBOE Volatility Index, a measure of expected volatility based on S&P 500 Index options. Over the last 10 years, the only time we have seen volatility of this magnitude was during the early days of the COVID pandemic.

Conversations matter during challenging times. We look forward to connecting with you to review your wealth management plan soon. As always, please do not hesitate to reach out to us at any time with questions or concerns.

Please find this newsletter and others on our website at www.gardecapital.com.

This article was published by Garde Capital, Inc. a Seattle based Registered Investment Advisor that provides wealth management solutions to individuals and families, nonprofit organizations, and corporate retirement plans.

Copyright 2025 by Garde Capital, Inc.