Market Monitor: April 2024

As we exit the first quarter of 2024, we are all still waiting. The Federal Reserve is still waiting on more economic data to determine whether there is justification to lower short-term interest rates. Stock investors are happily putting money to work while still waiting for the economy to show signs of cooling off. Bond investors are still waiting for the rebound from 2022 that hasn’t happened yet. In the meantime, global stock indexes have begun the year with a strong rally, and a slew of economic data points are helping chart a course for optimism, at least for the moment.

1st Quarter Highlights

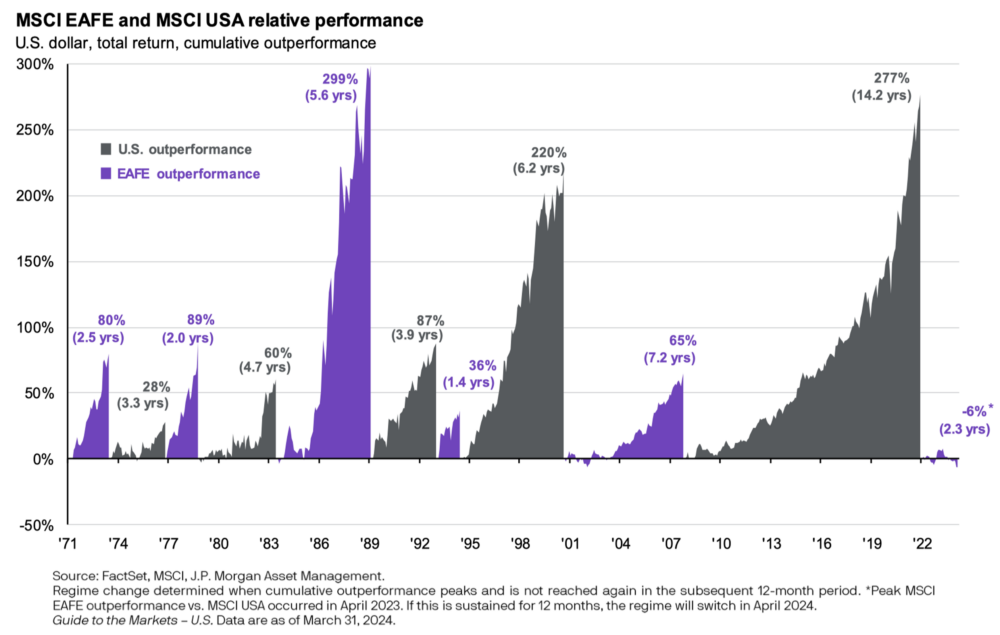

- Stocks picked up where they left off at the end of 2023. The S&P 500 Index of large U.S. companies returned 10.6% for investors, one of the best first quarters on record. Non-U.S. developed stocks again lagged U.S. stocks but posted solid results, increasing 5.8% for the first three months, as measured by the MSCI EAFE Index. The Russell 2000 Index of small cap U.S. stocks rose 5.2%.

- The Bloomberg Aggregate Bond Index finished the quarter down slightly at -0.8%. Intermediate-term interest rates rose slightly during the quarter with the 10-Year U.S. Treasury Bond yield increasing from 4.0% to 4.3%. After a brief rally in the final months of 2023, bond investors wait on the sidelines for signs from the Fed that the coast is truly clear on the inflation front.

- The March CPI reading rose slightly to 3.5% according to the U.S. Bureau of Labor Statistics. The Fed continues to feel that they do not have quite enough data to determine the future course for short-term rates. They would prefer to see inflation headed more firmly in the direction of their 2.0% longer term target. Those who were counting on several cuts in the first half of 2024 may have to wait longer to see if the Fed cuts rates at all during 2024. Interestingly, while the inflation reading itself has moderated, the prices of goods and services continue to rise from already high levels which represents a challenge for many consumers.

- The U.S. economy remained strong with GDP showing solid growth of 3.4% in the 4th quarter of 2023 and historically low unemployment ticking down slightly to 3.8% in March 2024. Corporate earnings also continue their positive trend with many analysts predicting double digit gains for 2024.

- The elections in November loom large for many investors. While the issues at hand are important for the country and potentially the economy, they may not be as critical for the markets. Investors might be surprised to know that historical volatility in election years doesn’t differ much from that in non-election years, and pales in comparison to the volatility we have seen in years with major economic events.

Three Big Things

Here we review some emerging trends that may be important for investors and their portfolios. We look at the market volatility during election years, the relationship between job openings and unemployment, and the impressive run of U.S. market dominance.

Volatility and Elections

Most investors worry about volatility, specifically volatility to the downside in response to major economic events. Presidential elections represent a source of anxiety for many and bring with them an anticipation of major market movements. But history has shown that election year volatility has been fairly benign, perhaps because elections don’t necessarily portend major economic change. The chart below shows election year trends compared to other years of economic upheaval.

Job Growth and Hiring

The ratio of unemployed persons in the U.S. to job openings remains historically low at 0.7, as shown below. More interestingly, this ratio has been level at 0.7 since May 2023 implying that the pace of job openings has kept up with the positive trends in hiring. While this has translated to a feeling among many employers that it is difficult to hire new people, those that wish to work have been able to find jobs in this growing economy, an encouraging sign.

U.S. Leading the Way

Historically, investors have experienced a routine changing of the guard of U.S. and non-U.S. market leadership, but for the last 15 years, it has been mostly one sided. Since the Credit Crisis, U.S. markets have led the way with minimal challenge from developed non-U.S. markets. As a result, valuations and dividend yields now appear more attractive in foreign markets. As the path of global interest rates evolves during 2024, we may also gain clarity on the appetite for investors to look outside the U.S. for opportunities.

We look forward to continuing our work together in 2024 and the opportunity to review your wealth management plan in the coming months. As always, please do not hesitate to reach out to us at any time.

Please find this newsletter and others on our website at www.gardecapital.com.

This article was published by Garde Capital, Inc. a Seattle based Registered Investment Advisor that provides wealth management solutions to individuals and families, nonprofit organizations, and corporate retirement plans. Copyright 2024 by Garde Capital, Inc.