Market Monitor: January 2026

After a major disruption in the first quarter of 2025 due to the disjointed tariff rollout, equity markets resumed their upward progress and finished the year in impressive fashion. Patient investors in large U.S. stocks were rewarded with a return of almost 18%. This would be remarkable in any year, but it comes on the heels of 2023 and 2024 returns that were both in excess of 25%. And if that statistic wasn’t enough to get excited about, non-U.S. stock returns were even better in 2025. Can this momentum continue? History would tell us that this level of performance will eventually moderate. For the time being though, earnings growth is strong, and we seem to be on the verge of more fiscal and monetary stimulus to keep the party going, at least for now.

4th Quarter Highlights

- The S&P 500 Index of large U.S. stocks rose 17.9% for the year. Growth stocks led the way once again with a return of 19.4% as measured by the Vanguard Large Growth ETF. Value stocks weren’t far behind. The Vanguard Large Value ETF increased 15.3% during the period. AI continued to be in focus as an enormous amount of investment is occurring in the sector.

- Some investors may not be aware that there was an even better place to make money this year than U.S. growth stocks. Non-U.S. developed markets rose 31.2% as measured by the MSCI EAFE Index. The MSCI Emerging Markets Index also had a great year, increasing 33.6%. Compelling valuations, positive earnings revisions, and a weak U.S. dollar powered foreign stocks to their best returns in a decade for U.S. holders of those assets.

- Positive returns on bonds and many commodities were a welcome complement to the strong equity gains in 2025. The Bloomberg U.S. Aggregate Bond Index bounced back with a 7.3% return, helped by declining interest rates and inflation that remains somewhat muted. The 10-Year U.S. Treasury yield finished the year at 4.16% compared to a yield of 4.57% at the start of 2025.

- The Federal Reserve has a stated goal of bringing inflation (annual growth in prices as measured by CPI) back down to its long-term target of 2%. CPI growth fluctuated between 2.3% and 3.0% during the year, ending with the most recent reading of 2.7% in November.

- The risk trade is still on as investors seem convinced of two things: first, the current level of inflation will not be an impediment to consumer spending, and second, that short-term interest rates will continue to decline as President Trump appoints a new Fed Chair during 2026. The two top candidates at this point appear to be Kevin Hasset and Kevin Warsh, both of whom seem to favor reducing rates in the near term.

- The Supreme Court, having heard arguments about the validity of the Trump tariffs, will weigh in with a decision in the coming weeks. It remains to be seen what impact that decision may have on the economy and markets.

- As of this writing, the U.S. is now the de facto leader of Venezuela, having removed President Nicolás Maduro from power in the early days of January. Venezuela is relatively small on the economic stage, representing less than 0.5% of global GDP. While markets may be able to absorb this recent news, the prospect of the political fallout and potential geopolitical uncertainty may still be unsettling for some investors.

Three Big Things

Here we review some emerging themes that may be important for investors and their portfolios. In this edition, we look at consistent U.S. GDP growth, the positive trend in corporate earnings, and the meteoric rise in the price of gold.

GDP Growth Remains Steady

Investors initially speculated that the rollout of the Trump tariffs would have a detrimental effect on the markets and the growth of the U.S. economy. As we look at U.S. GDP during the last year, we find that economic growth at around 2.5% is very much in line with the trend we have seen over much of the last decade. It is also useful to note that the current expansionary cycle (post Credit Crisis) has only seen one small recessionary period.

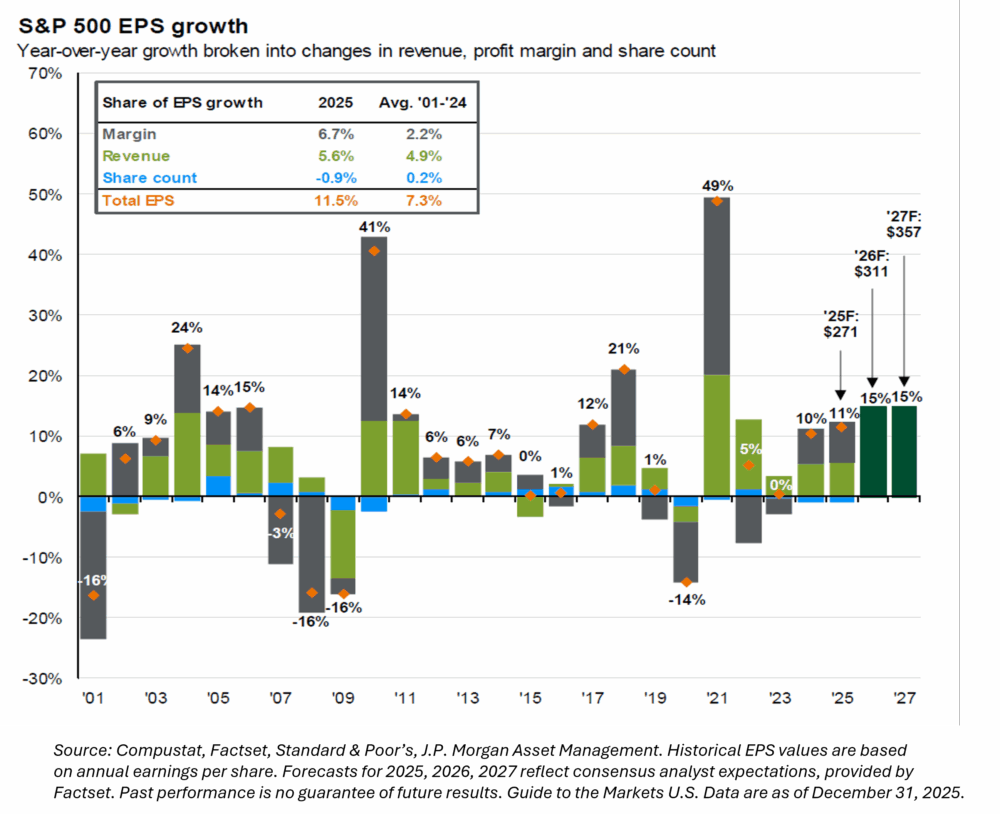

Corporate Earnings on the Rise

With a second year of corporate earnings growth above 10% and predictions of higher growth in the years to come, investors are happy taking risk at the moment. Cost cutting and strong pricing trends at large companies have led to margin expansion, and consumers have continued to spend at a rapid clip. Can the AI rollout lead to more efficiencies in the years to come? Will tariff costs ultimately be passed on to consumers? 2026 should provide many answers for investors.

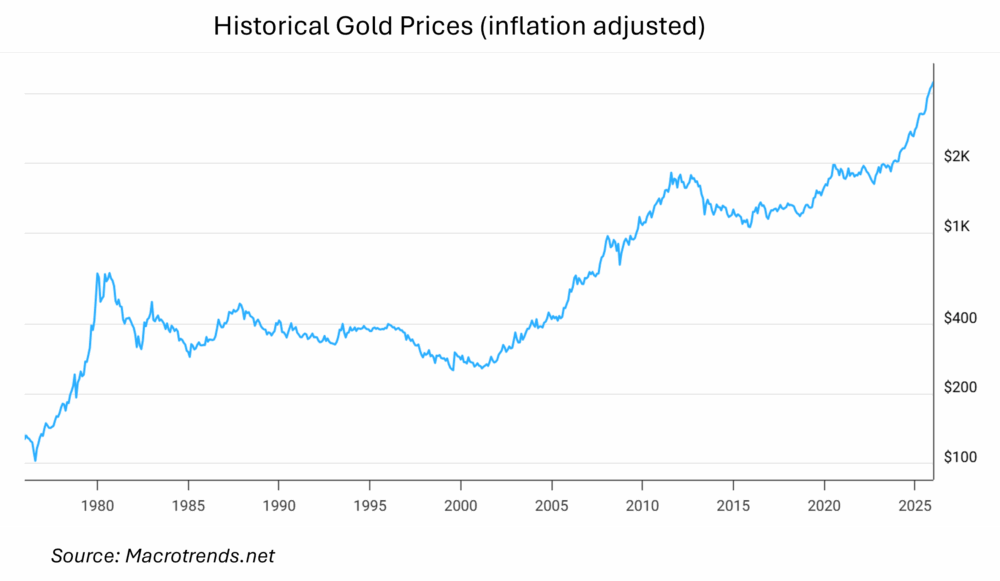

An Epic Run for Gold

The rise in the price of gold has been one of the most compelling financial news stories during 2025. The value of the precious metal increased by 64.5% this year alone. Assigning reasons for the rise and fall of gold continues to be a favorite pastime for investors. Gold has at times been viewed as a hedge against the U.S. dollar, a hedge against inflation, a bastion of safety in times of market stress, and a non-correlated asset for diversified portfolios. Gold is a speculative instrument, and this is not the first time we have seen this type of volatility. The history books will note that after the peak of gold prices in 1980, it took another 27 years to return to those levels.

Happy New Year! As we welcome 2026, we once again look forward to connecting with you to review your wealth management plan. As always, please do not hesitate to reach out to us at any time with questions or concerns.

Please find this newsletter and others on our website at www.gardecapital.com.

This article was published by Garde Capital, Inc. a Seattle based Registered Investment Advisor that provides wealth management solutions to individuals and families, nonprofit organizations, and corporate retirement plans.

Copyright 2026 by Garde Capital, Inc.