Market Monitor: July 2025

The second quarter of 2025 was marked by significant legislative, economic, and market developments with broad implications for investors. In early July, Congress passed the One Big Beautiful Bill Act (OBBBA), a sweeping tax and spending package that makes permanent the 2017 tax cuts, raises the federal estate tax exemption, and introduces a variety of spending cuts to government programs. Financial markets showed resilience despite ongoing geopolitical tensions, with U.S. equities finishing the quarter on a high note and fixed income markets stabilizing after early-year volatility. As the U.S. economy continues to grow and unemployment remains low, investors are looking to the Fed for any sign of movements in short term interest rates. Further information about the impact of tariffs and inflation will inform that decision and may provide some insight about the remainder of 2025.

2nd Quarter Highlights

- After being down over 15% during the tariff frenzy of early April, large U.S. stocks have rallied back strongly. The S&P 500 Index of large U.S. stocks finished the second quarter up 6.2% for the year and hit a new all-time high in early July.

- For the month of June alone, the Vanguard Technology Index rose 9.5% as tariff concerns eased and investors regained confidence in the prospects for continued economic growth.

- International stocks continue to be the market story of the year. The MSCI EAFE Index of non-U.S. developed stocks finished the quarter up 19.5% for the year. During the 6-month period, the U.S. Dollar declined more than 10% compared to a basket of non-U.S. currencies which contributed to the impressive international stock performance.

- S. bonds returned 4.0% for investors during the first half of 2025, as measured by the Bloomberg U.S. Aggregate Bond Index. Despite persistent investor concerns about the level of interest rates, the yield on the 10-year U.S. Treasury index declined noticeably from 4.6% in January to 4.2% at quarter end.

- The Federal Reserve continues to feel pressure from the Trump administration to lower interest rates, but they seem to be in no hurry to do so. Inflation remains slightly above the Fed’s 2.0% target, reading 2.4% in May. The Fed seems content to hold short term rates at 4.25%-4.50% so long as economic growth remains stable, unemployment remains low, and the inflation impact of tariffs is still unclear.

- After another brief pause, the President is poised to continue his campaign to reshape global trade. Most major trading partners of the U.S. now have at least a 10% tariff in place on U.S. exports, while specific deals are being discussed. To date, only the U.K. and Vietnam seem to have arrived at a more permanent agreement.

- Geopolitical tensions remain high with ongoing wars in Ukraine and Gaza and the recent bombing of Iranian nuclear facilities by the U.S. To date, however, these potential risks have not quelled investor optimism as we enter the third quarter.

- The One Big Beautiful Bill Act (OBBBA) finally made its way to the President’s desk in early July after a host of revisions between the House and Senate. We will learn over time the true impact of this major tax and spending initiative. In the meantime, please read our Tax Update piece that summarizes the key provisions of the bill.

Three Big Things

Here we review some emerging themes that may be important for investors and their portfolios. We look at the relationship between Treasury yields and mortgage rates, the trend in Federal government deficits, and the predictive nature of fixed income yields.

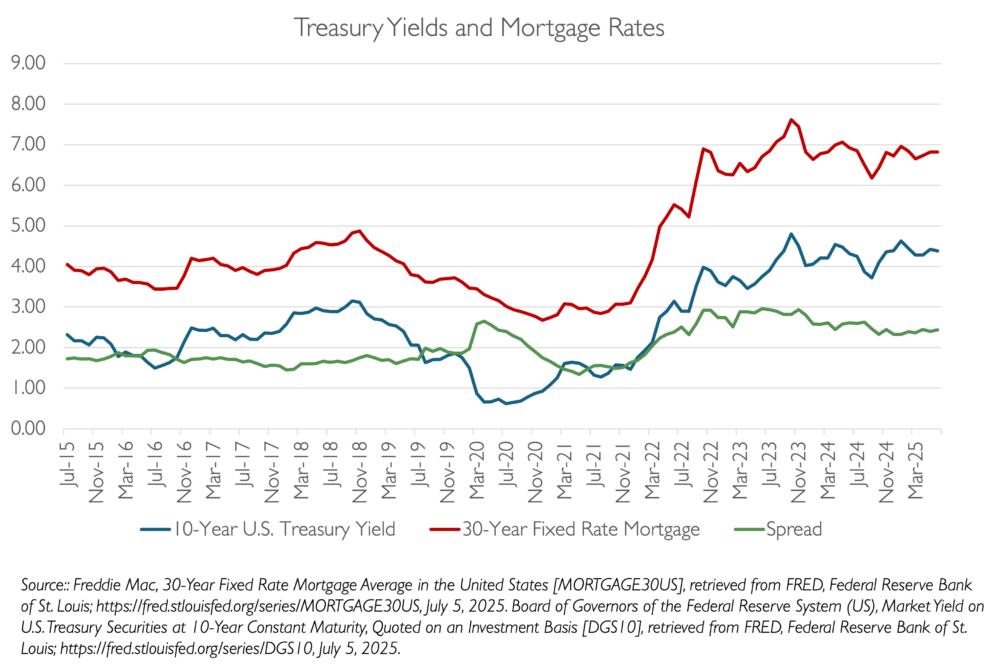

Treasury Yields and Mortgage Rates

While the rates on both 10-Year Treasury bonds and 30-Year Fixed Rate Mortgages have stabilized, they remain at relatively high levels. Homebuying has been more challenging as a result, causing payments for recent home purchasers to consumer greater portions of their monthly budgets. The data below also reveals a fairly consistent relationship of these two rates over time. With interest rates in the spotlight for 2025, investors will be looking to the Treasury market for clues about the future path of mortgage rates.

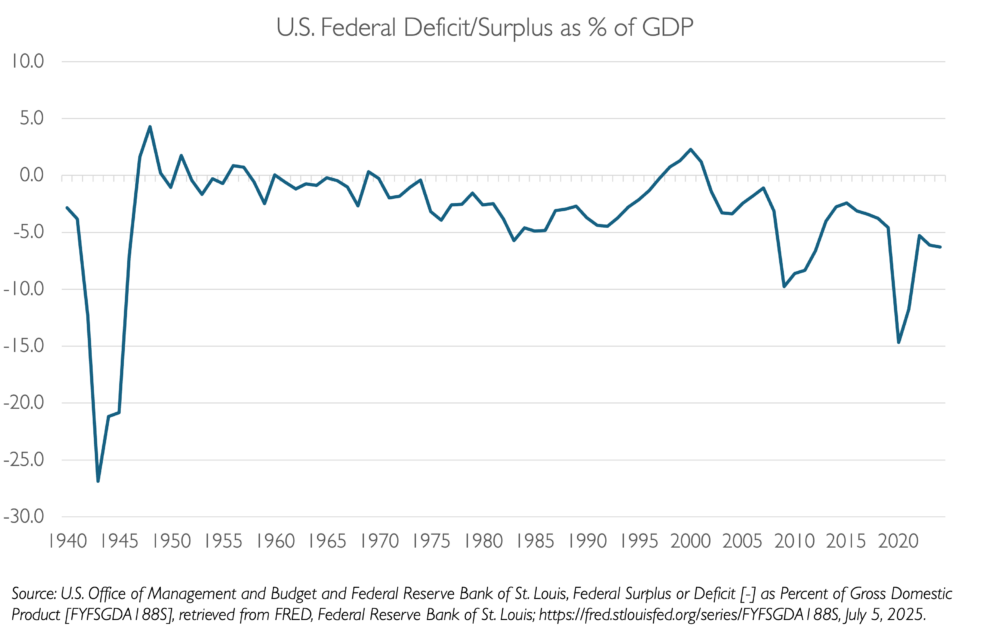

Federal Government Deficits

The chart below shows the post-World War II trend in the U.S. Federal budget surpluses and deficits. While we have seen brief periods of budget surpluses, deficits are more the norm, and that trend appears to show no signs of abating in 2025 and beyond.

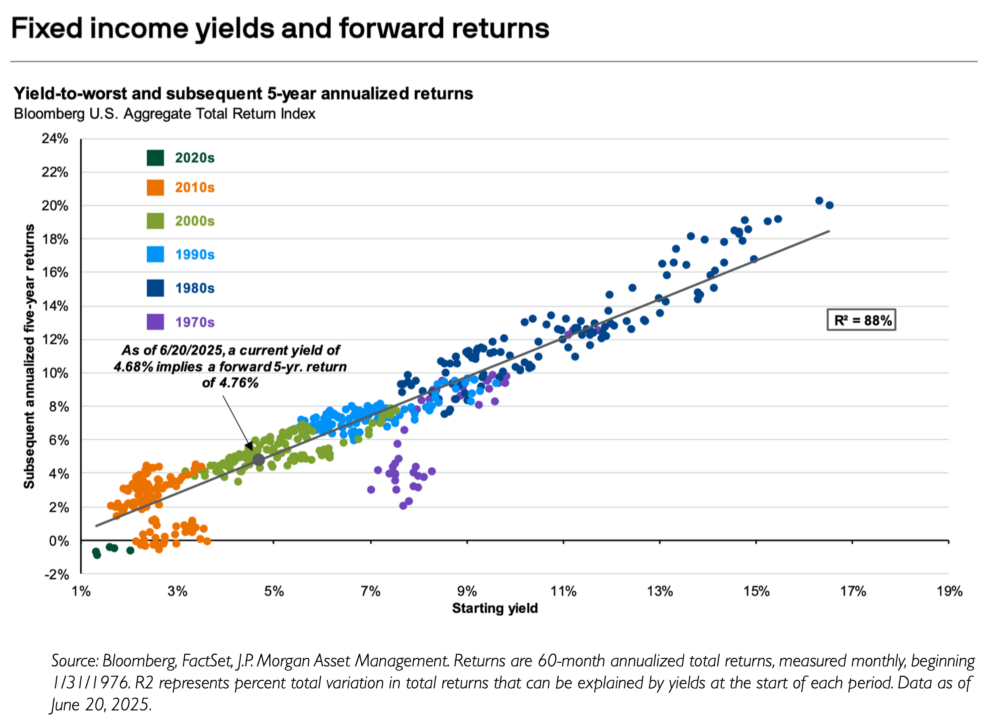

Fixed Income Yields and Forward Returns

Investors have lamented the drag on portfolio performance of the fixed income market in recent years. As rates started from a low point 5 years ago and inflation reared its ugly head, many investors sold bonds and looked for other return opportunities. However, yields at nearly 5% on bond portfolios today look much more attractive for a 5-10 year holding period. The chart below illustrates the relationship between bond yields and 5-year annualized returns over the last 50 years. With few exceptions, the correlation of yield to maturity and annualized returns is high and should give bond investors today much more confidence.

We look forward to connecting with you to review your wealth management plan soon. As always, please do not hesitate to reach out to us at any time with questions or concerns.

Please find this newsletter and others on our website at www.gardecapital.com.

This article was published by Garde Capital, Inc. a Seattle based Registered Investment Advisor that provides wealth management solutions to individuals and families, nonprofit organizations, and corporate retirement plans.

Copyright 2025 by Garde Capital, Inc.