Market Monitor: October 2024

We have entered new era, one we haven’t seen since 2019, a world where the Federal Reserve is reducing interest rates. The 0.50% cut at the September meeting likely marked the first of a number of rate cuts by the Fed in their efforts to become more accommodative and facilitate continued economic growth and labor market strength. As of this moment, the economy is still growing steadily and the idea of a “soft landing” is very much in play. With AI as a continued backdrop, stocks were up solidly in the third quarter of 2024. On the domestic front, many eyes are now focused on the outcome of a hotly contested Presidential election and further revelations about policies that may be on the table during the next cycle.

3rd Quarter Highlights

- The S&P 500 Index continued its impressive run, up another 5.8% in the third quarter to finish September with a return of 22.1% for the year. Non-U.S. developed stocks (MSCI EAFE Index) also gained, increasing 13.0% for the year, and emerging markets (FTSE Emerging Markets Index) rallied strongly to finish the quarter with a 20.2% year-to-date gain.

- Signs of life are emerging in many segments of the market. Growth stocks were actually the laggard of the bunch, having been outpaced by value, small cap, and non-U.S. stocks in the quarter. This is remarkable, as growth has led the way over most periods in the last decade.

- Inflation continues to slow, paving the way for several more potential rate cuts before the end of 2024. CPI increased only 2.6% in August compared to last year.

- The bond market responded well to the anticipated moves by the Fed, with the Bloomberg Aggregate Bond Index up 5.2% for the third quarter. Bond investors are now in a position to take advantage of nearly 4.5% yields on high quality bonds knowing that there may be upside potential in store as the Fed continues their loosening stance.

- Emerging markets, although a relatively small position in many portfolios, showed surprising strength in the quarter. Chinese stimulus, U.S. rate reductions, higher yields, and falling inflation in many emerging countries all contributed to the gains.

- While many investors anxiously await the outcome of the U.S. election in November, we are reminded that election years are generally positive years in the market and almost never represent a call to action for changes in a diversified portfolio.

- We will, however, be on the lookout for major policy changes that could provide opportunities for optimization of our wealth management plans. Among them, the potential sunset of tax provisions from the 2017 Tax Cuts and Jobs Act could bring changes in individual income tax rates and other estate tax laws. We look forward to being in touch with recommendations specific to your planning.

Three Big Things

Here we review some emerging trends that may be important for investors and their portfolios. We look at the relationship between mortgage rates and the 10-Year Treasury yield, the probabilities of upcoming Fed rate cuts, and a healthy perspective on investing for the long term.

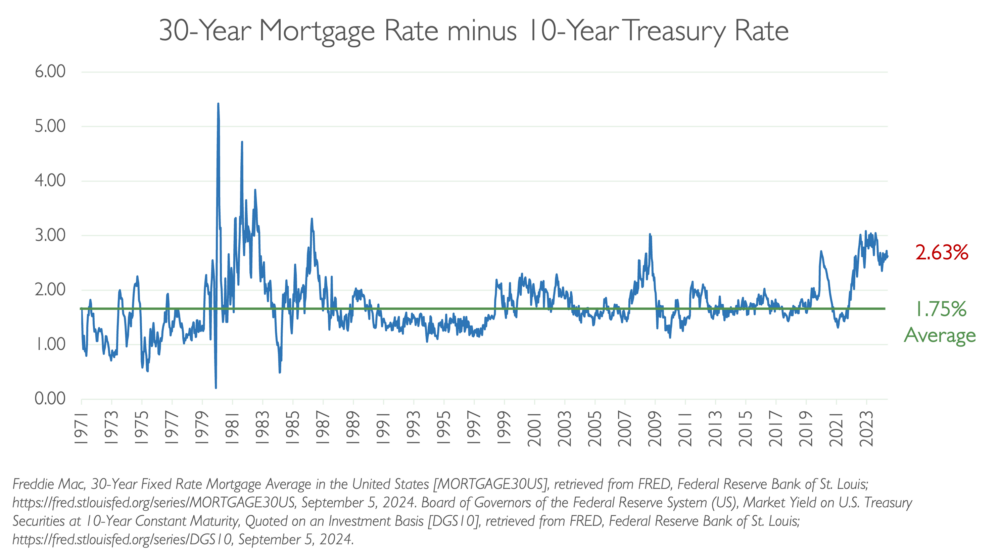

Mortgage Rates vs. Treasury Yields

The chart below shows the historical relationship between the 30-year mortgage rate and the 10-Year U.S. Treasury yield. There has been plenty of volatility in the spread between these rates. On average, the mortgage rate has been about 1.75% higher than the Treasury yield over the last 50 years. That spread was recently measured at 2.63%. That larger than normal gap may stand a chance to narrow in a falling rate environment which could be helpful for participants in the real estate market.

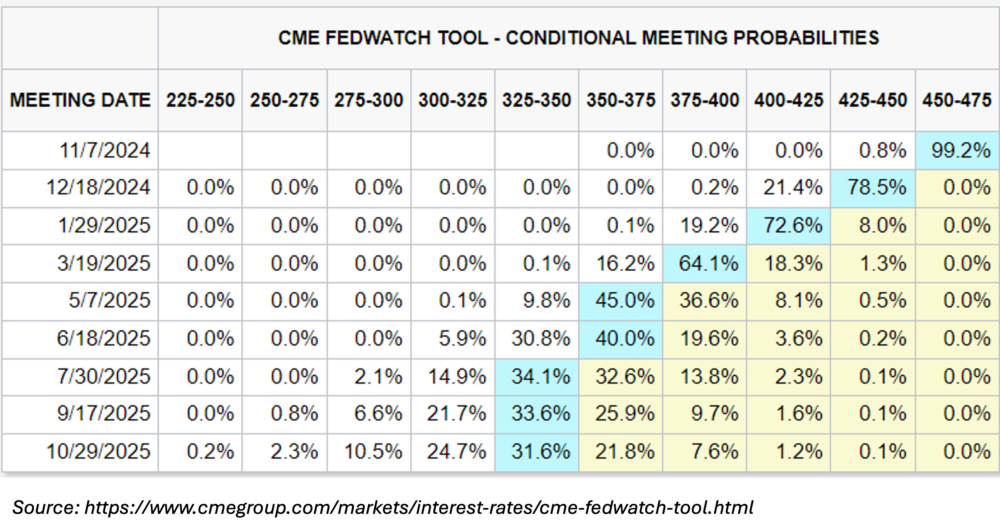

Fed Funds Probabilities

The Fedwatch Tool is a collection of data based on the pricing of market instruments that shows predictions about the Fed Funds Rate at future Fed meeting dates. This chart indicates that for the November 2024 meeting, there is a 99.2% probability that the Fed Funds Rate will be between 4.50%-4.75%. This would imply a 0.25% cut from the 4.75%-5.00% level that exists today. There is also a 0.8% probability of a 0.50% cut at the next meeting. For the December meeting, there is a 21.4% probability that Fed Funds will be between 4.00% and 4.25%, a 0.75% decrease. Actual future Fed Funds Rates are not known with certainty, but it is worth noting that the market believes, with 100% confidence, that Fed Funds will be lower by year end.

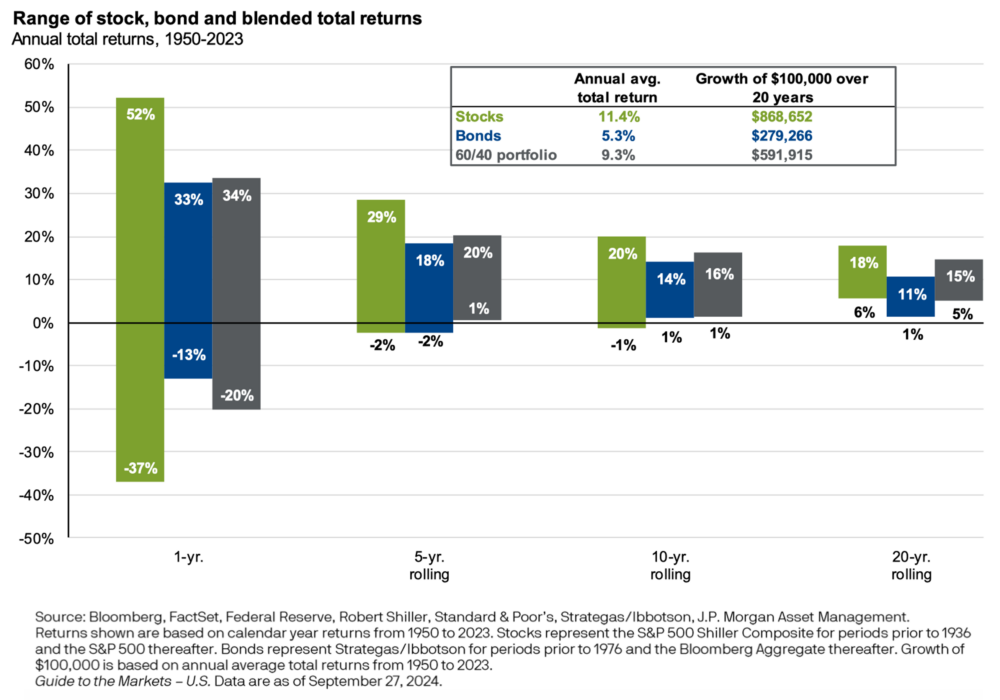

The Long Game

Investors often become consumed with the impact of current events, like elections, on near term market returns. We simply have no way to predict short term market behavior. However, we do have much greater confidence about the range of returns for longer holding periods. The chart below indicates that over 1-year holding periods, the balanced 60/40 portfolio has seen a range of returns from -20% to +34%, but for 20-year holding periods, that window of possibility compresses dramatically to a range of +5% to +15%. A commitment to staying invested in a diversified and balanced portfolio ensures that we don’t need to predict what happens next in order to be successful over the long term.

We look forward to the opportunity to review your wealth management plan in the coming months. As always, please do not hesitate to reach out to us at any time.

Please find this newsletter and others on our website at www.gardecapital.com.

This article was published by Garde Capital, Inc. a Seattle based Registered Investment Advisor that provides wealth management solutions to individuals and families, nonprofit organizations, and corporate retirement plans. Copyright 2024 by Garde Capital, Inc.